Revolutionizing Banking: The Promise of Blockchain Technology

December 27, 2024 - 04:09

With transparency, security, and reliability embedded at its core, blockchain technology is more than just a tool for enhancing existing banking systems; it embodies the model that modern banking should strive to achieve. As financial institutions face increasing pressure to adapt to a rapidly changing landscape, blockchain offers a transformative solution that can redefine the way banks operate.

The decentralized nature of blockchain ensures that transactions are secure and transparent, minimizing the risk of fraud and enhancing customer trust. By eliminating intermediaries, blockchain can streamline processes, reduce costs, and improve efficiency, ultimately benefiting both banks and their clients. This technology allows for real-time transactions and greater accessibility, making banking services more inclusive for a broader audience.

As banks begin to explore the potential of blockchain, they are poised to evolve into institutions that prioritize customer needs and operational integrity. The future of banking may very well hinge on the successful integration of blockchain, paving the way for a more equitable and reliable financial system.

MORE NEWS

March 7, 2026 - 23:03

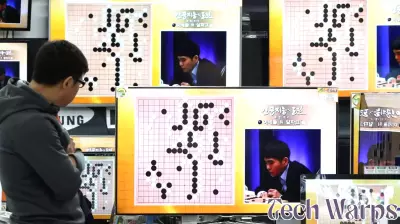

The moment that kicked off the AI revolutionTen years have passed since a pivotal moment in Seoul, South Korea, where the world watched champion Lee Sedol fall to DeepMind`s artificial intelligence, AlphaGo. That stunning victory in the...

March 7, 2026 - 02:53

Whole Health consortium advances mental, rural, and technology researchA major health consortium has announced significant progress in its mission to tackle some of the most pressing issues in modern healthcare. The initiative is channeling substantial funding into...

March 6, 2026 - 09:48

**Regulators Affirm Existing Rules Apply to Tokenized Assets**In a significant move for the digital asset space, federal banking regulators have clarified that securities existing on blockchain networks are subject to the same regulatory framework as their...

March 5, 2026 - 19:56

Fulton County organization launches career development system using technologyA new initiative in Fulton County is harnessing technology to bridge the gap between local job seekers and employers. The Fulton County Center for Regional Growth has officially launched a...